unrealized capital gains tax bill

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Schedule A Discovery Call Today.

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Even though reports suggest the proposed. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

Senate Finance Committee Chairman Ron Wyden D. This bill prohibits the Department of the Treasury or any other federal official. An unrealized gain is an increase in your investments value that you have not captured by selling the investment.

House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill. Ad You Deserve A Cost Segregation Partner You Can Trust Who Will Also Produce Results. The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years.

5814 is a bill in the United States Congress. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring. The Problems With an Unrealized Capital Gains Tax.

A lot of lies being spread about the proposed unrealized capital. The Democrats have stressed that taxes will not be increased on middle- and working-class Americans. A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law.

To increase their effective tax rate. Introduced in House 11022021 Prohibiting Unrealized Capital Gains Taxation Act. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

When Quality Counts Our Cost Segregation Studies Deliver. We probably will have a wealth. Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396.

Unrealized gains are not taxed until you sell the investment. The largest part of the tax bill will be upfront. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US.

Under the proposed Billionaire. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark Zuckerbergs.

Mitt Romney R-Utah told. If you hold an asset for less than one year and sell for a capital gain the. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Analyze Portfolios For Upcoming Capital Gain Estimates.

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Dealing With Unrealized Capital Gains Acm Wealth

U S President Biden Unveils Unrealized Capital Gains Tax For Billionaires Swfi

Biden To Propose 20 Tax Aimed At Billionaires Unrealized Gains Bloomberg

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Opinion This Plan To Force The Wealthy To Pay Yearly Capital Gains Taxes Won T Solve The Real Problem Marketwatch

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Strategies For Investments With Big Embedded Capital Gains

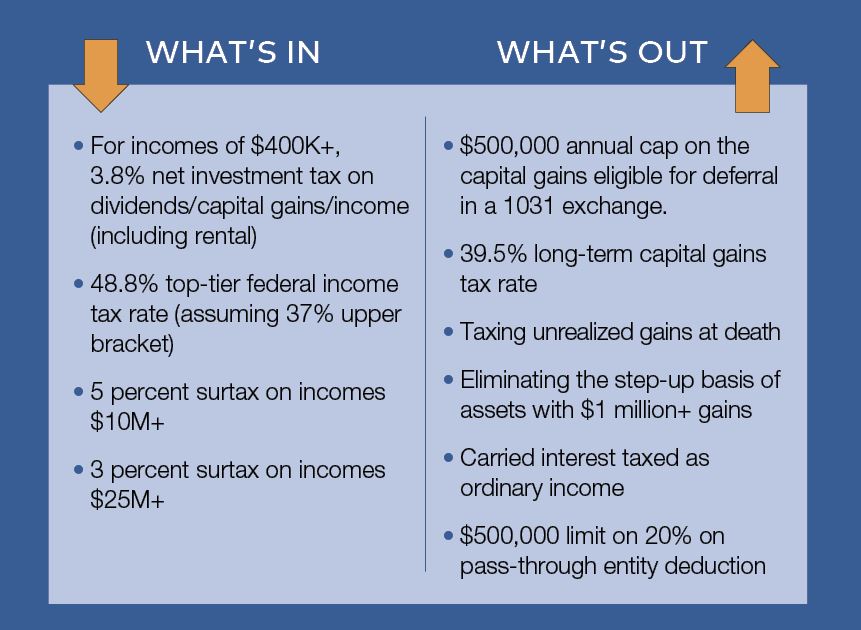

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

How Could Changing Capital Gains Taxes Raise More Revenue

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Hiltzik Why Elon Musk S Taxes Are Important Los Angeles Times

High Class Problem Large Realized Capital Gains Montag Wealth

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)